In relation to guarding your self, All your family members, or your enterprise, among the best tools at your disposal is an extensive insurance coverage solution. Insurance plan options are like a safety Internet while in the unpredictable circus of lifetime, providing you the comfort that, no matter what occurs, you will not should confront money destroy. But what exactly helps make up a great insurance plan Resolution? And How will you make certain that the one particular you choose suits your requirements properly? Allow’s dive into the topic and explore every little thing you need to know.

At its core, an insurance policy Resolution is simply a means to transfer the danger of economic loss from you to definitely an insurance provider. Inside of a earth exactly where points can go Mistaken in an instant—no matter whether via mishaps, health problems, residence destruction, or unpredicted occasions—a sound insurance coverage Answer can protect you from the mountain of worry. Photograph it similar to a shield that safeguards your finances when matters don’t go as prepared.

The Buzz on Insurance Solution

Although not all insurance coverage answers are exactly the same. You'll find plenty of selections in existence, Each and every tailored to various demands. Do you need overall health coverage, residence coverage, lifetime insurance policy, Or possibly a combination of all three? The solution relies on your conditions. The main element to getting the most out of one's coverage Alternative lies in knowing what protection you may need And exactly how Each individual coverage works to satisfy Individuals requires.

Although not all insurance coverage answers are exactly the same. You'll find plenty of selections in existence, Each and every tailored to various demands. Do you need overall health coverage, residence coverage, lifetime insurance policy, Or possibly a combination of all three? The solution relies on your conditions. The main element to getting the most out of one's coverage Alternative lies in knowing what protection you may need And exactly how Each individual coverage works to satisfy Individuals requires.One thing to take into consideration is whether or not you would like a more common or specialised insurance policy Option. Lots of people could Opt for the simplest possibility—a primary, one-measurement-matches-all plan that gives general protection. This could be plenty of for someone just beginning or a person who doesn’t have lots of assets to shield. Conversely, extra specialised answers is likely to be necessary for Individuals who have specific requirements, like business people who need business insurance policy or somebody with special wellness wants that desire far more customized protection.

So, How does one go about selecting the suitable Option? Step one is To guage your needs. Start by asking you, “What am I attempting to safeguard?” Are you currently looking for coverage for the wellness, house, or relatives? Knowing your priorities will assist you to slender down your selections and be certain that you choose an insurance solution that provides you reassurance without the need of purchasing needless coverage.

One widespread miscalculation folks make When selecting an coverage Remedy is assuming that The most cost effective choice is the greatest. Whilst preserving revenue is crucial, picking the the very least high-priced coverage policy may leave you underinsured. Consider purchasing a Wintertime coat on sale—It is cheap, nevertheless it isn't going to preserve you warm in the snow. Precisely the same logic applies to insurance policy: you don’t choose to Slice corners when it comes to preserving what matters most to you.

An important Consider deciding on the correct insurance coverage Alternative is comprehension the differing types of protection. Overall health coverage, for example, is designed to help with the costs of professional medical care. But in just this group, you’ll uncover alternatives like personal or household protection, significant-deductible options, and a lot more. Each of these options provides distinctive levels of coverage, so it’s imperative that you choose one that aligns with all your clinical requirements and budget.

On the subject of property or automobile coverage, the Tale is analogous. Does one individual a vehicle or rent a home? The type of coverage you'll need will vary according to your predicament. Homeowners could possibly need to have procedures that protect every thing from hearth harm to theft, though renters may possibly only want coverage for private belongings. In the meantime, in the event you have a company, you’ll will need professional insurance policy to guard both equally your physical belongings and also your workforce. To put it briefly, just about every insurance plan Alternative is intended with a specific have to have in mind.

An additional significant facet of an insurance policy Alternative is the assert method. How easy is it to file a assert if one thing goes wrong? Preferably, you wish an insurance provider with a simple, trouble-cost-free course of action Learn more that doesn’t insert stress after you have to have aid probably the most. Think about it like a friend who can help you thoroughly clean up the mess when factors collapse, as an alternative to somebody that makes the job more challenging than it has to be.

Choosing the correct insurance policy Option is all about being familiar with the good print. From time to time, guidelines can feel mind-boggling with all their stipulations. But You should not shy faraway from studying by means of them. What’s provided? What’s excluded? Are there any hidden service fees? Question questions and ensure you understand just what you might be signing up for before committing.

An frequently-ignored function of many coverage methods is the flexibleness they supply. As your daily life modifications, your insurance plan needs may possibly evolve likewise. Maybe you get married, have children, start a business, or purchase a household. You will need an insurance solution which will regulate to those modifications. Some insurance policies let you maximize or lessen coverage, while others may well even assist you to incorporate new attributes like disability or accidental Dying protection.

A different point to consider may be the status on the insurance plan supplier. An insurance company which has a strong reputation is much more more likely to be honest and dependable any time you will need them most. You don't want to find that your insurance company is slow to pay for promises or difficult to talk to when disaster strikes. So, evaluate customer reviews, ask for suggestions, and carry out some research prior to making your ultimate final decision.

Insurance coverage alternatives are all about equilibrium. You don’t need to underinsure your self, leaving gaps that can cost you later on, but In addition, you don’t wish to overpay for needless coverage. Acquiring that sweet spot involving rate and safety is crucial. Occasionally, This suggests dealing with an agent who may help you tailor your policy to satisfy your preferences and funds.

A great deal of people think that insurance is just about the obvious stuff—health, property, and car. But insurance alternatives might also prolong to less apparent spots, like lifestyle insurance policy or enterprise interruption insurance. Life insurance plan ensures your family members are financially secure if anything comes about for you, even though business interruption coverage protects your company in the financial effects of surprising closures or disruptions.

About Insurance Solution

Some Ideas on Insurance Solution You Should Know

Sometimes, an insurance plan Option isn’t almost safeguarding assets. It might also deliver fiscal relief in the shape of income substitution. This is particularly vital in the case of incapacity insurance policy, which helps switch misplaced revenue if you are not able to do the job as a consequence of an injury or ailment. Getting this security Internet in position can be quite a lifesaver if you are not able to get the job done for an prolonged interval.

When you’re a company proprietor, insurance policy options are even more very important. Don't just do you have to safeguard your Actual physical property, but You furthermore mght want to shield your employees and make sure your organization can carry on working inside the deal with of setbacks. Commercial insurance policy can go over all the things from residence damage to legal responsibility claims, and the best insurance policies Resolution is usually the difference between being afloat or sinking below fiscal pressure.

When contemplating your insurance coverage Resolution, usually remember that you are not by itself in this decision. Insurance agents are there to help you manual you, clarify your choices, and remedy any questions you'll have. They can help you navigate through the complexities of various guidelines and ensure that you find the appropriate 1 for your one of a kind condition. Don't hesitate to achieve out for assist if you need it.

In the end, the very best coverage Remedy in your case may be the one which aligns with your requirements, funds, and Life-style. It is a customized decision, and the more informed you're, the better your odds of finding a policy that really shields what matters most. So just take your time, do your investigation, and pick correctly. In spite of everything, That is regarding your long term protection.

In conclusion, selecting the appropriate coverage Resolution is about being familiar with your requirements, exploring the various selections offered, and locating a company you could belief. Irrespective of whether It truly is well being insurance, residence insurance plan, automobile insurance, as well as lifetime coverage, a effectively-chosen coverage could be the distinction between flourishing and simply surviving. Guard on your own, your family, along with your potential with the correct insurance plan Remedy, and rest simple realizing that you're organized for what ever life throws your way.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Sam Woods Then & Now!

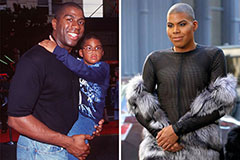

Sam Woods Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!